The Global Luxury Retailing 2023 Outlook report from Savills has been published. It observes that the pandemic has illustrated how strong luxury consumption is. The report also emphasises the significance of in-store luxury retail in our digital era.

Following the pandemic, as international travel recovers, getting consumers closer to luxury will be necessary for luxury brands to establish a competitive advantage. The report presents several key messages to consider.

Global expansion of luxury brands

New shop openings increased globally by 11% in 2022 compared to the previous year. China accounted for 41% of all new openings. Major brands have been focusing on the Chinese luxury market. This is especially true in the first half of 2023, when spending is mainly limited to domestic consumption.

Shop openings in Europe* increased by 77% year-on-year. This accounted for 23% of global openings, making it the second-highest region after China. The relatively rapid recovery of luxury consumption in Europe is partly due to the return of international tourists.

It should be noted that London stood out as a thriving luxury market in Europe last year, mainly due to the many new stores that opened on Bond Street, which is considered the city’s top luxury destination.

The pandemic has created more store activity opportunities due to lower rents and greater availability in specific markets. Some of the major luxury shopping streets have adjusted their shop rents accordingly, and although rental growth has returned, they are still 17% below their pre-covid peak as of Q1 2023.

*Europe is referred to as the continent, including the UK

The brick-and-mortar luxury experience

Luxury brands have been expanding their stores, especially in their home markets, to enhance the physical luxury experience for their customers. This trend has been ongoing and driven by a desire to elevate the luxury store experience. The pandemic did provide some with an opportunity to increase availability and rebased rents in some key luxury locations. Brands can showcase their complete line of products in these spacious areas.

Mainland China remains a significant consumer market for luxury goods

Mainland China is a key luxury market, accounting for 17% of global sales in 2022. It also dominated new store openings, making up 41% of them. This is due to brands’ focus on the Chinese market, according to Bain.

Hong Kong is also a key luxury market. Visitors from mainland China have declined in recent years, resulting in a drop in market share. However, a reversal is predicted for 2023. By 2024, 55 million visitors will have returned to Hong Kong, reaching pre-covid levels. This will lead to an increase in luxury sales.

Even though rents have risen there, rents for major shops are 10% lower relative to pre-covid levels. Now is an excellent opportunity for luxury brands to enter the Hong Kong market. They have not yet opened any shops there.

Singapore, Thailand and Vietnam are becoming increasingly attractive to luxury retailers. This is due to their economic growth and a growing number of high-net-worth individuals. These countries are also developing a more luxurious image, with more luxury hotels and members’ clubs.

(Source: Savills Research)

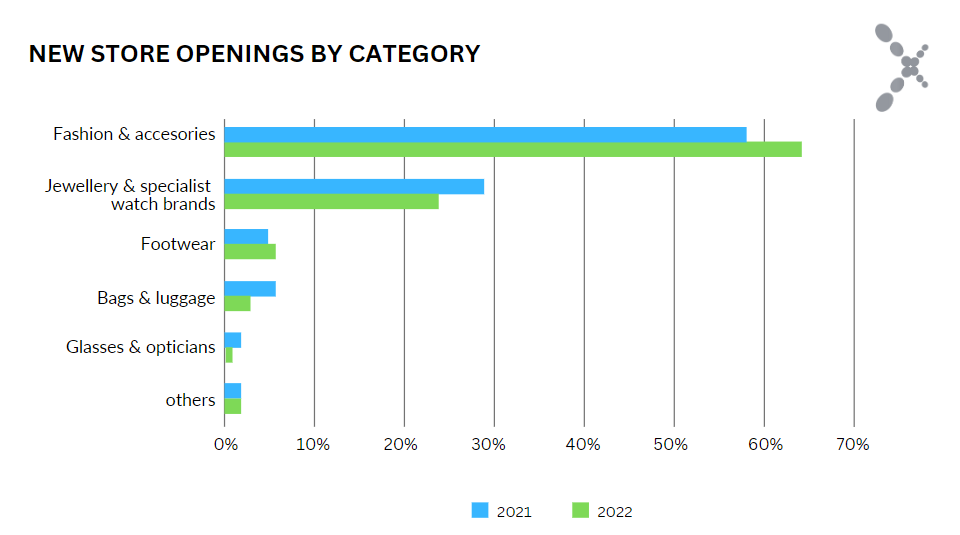

Returning to a normal lifestyle after the pandemic, fashion and accessory brands increased their activity, with new shop openings up 21% year-on-year. In contrast, jewellery and watch brands saw a decline in new shop openings, from 29% to 24%.

The pandemic and reduced outbound travel make the domestic market more attractive. Some new first- and second-tier cities for specialist watch brands, such as Chengdu, Chongqing and Fuzhou, saw increased sales activity. In Europe, activity was focused on smaller, affluent cities. Dublin was one of these cities. Luxury watch brands entered the market there by partnering with local operators.

Global alpha cities dominate new shop expansion, mainly from smaller alpha markets.

Global Alpha cities (defined by the Globalisation & World Cities Research Network) rank highly regarding economic, political, and cultural factors. These cities are London, New York, Paris, Shanghai, Milan, and Tokyo, among many other major metropolises.

These Global Alpha cities experienced a 25% surge in the opening of new stores, with their share of new store openings accounting for 45% of the total. Their expanding market share was helped by the fact that many of these cities are key international destination cities and the resumption of international travel with its increased luxury spend.

However, the growth in new shop expansion in global alpha cities was mainly driven by smaller alpha markets such as Milan, Madrid, Amsterdam, Los Angeles, and Toronto City, among other tourist cities, benefitting from a strong domestic and visitor profile, increased availability of luxury pitch, and the elevation of the hospitality offering within these cities created new luxury retail destinations.

Where are the opportunities for 2023 and beyond?

Bain predicts that the global market for personal luxury brands will increase by 5-7% annually through 2030, for a total increase of over 50% to €580 billion. Brands continue to expand their stores to capture more sales.

For those brands looking for new space, 2023 is certainly a good opportunity to expand their stores. Overall, rents are still much lower in some luxury areas compared to the pre-covid period, and in the case of Toronto and London, the difference from 2019 is 21% and 17%, respectively.

Regardless of overall rents, major cities worldwide remain a strong draw for luxury brands alone. Location advantages continue to be a significant factor driving decisions. The following are the market opportunities identified in the report as worthy of attention by luxury brands:

- Canada: Oakridge Park, Vancouver & Royalmount, Montreal

- London: Northern segment of Bond Street

- California, US: Middle Plaza, Menlo Park

- Europe: Smaller, highly affluent cities

- Germany: Calatrava Boulevard, Düsseldorf

- Middle East: Saudi Arabia

- Southeast Asia: Vietnam and Thailand (relatively underserved market, growing middle class, return of mainland Chinese tourists)

- Hong Kong is an attractive market due to the return of Chinese tourists and lower rents in luxury shopping areas. These rents are now much lower than before the epidemic.

The report states that Chinese consumers have substantial spending power on luxury goods. In the post-pandemic era, Chinese consumers are already returning to international travel, Europe and UK are among their most favoured travel and shopping destinations; merchants in these areas should get prepared and take actions to win Chinese customers, such as raising brand awareness by marketing on popular Chinese social media platforms and optimising consumers’ experiences by integrating Chinese payment methods at check-out.

(Source: Savills; Bain)